The Government “Perk” That Can Hand Copywriters (Like You) a $2.52 Million Windfall

As if you needed any extra motivation to pursue your writing dreams — beyond the money, the personal freedom, and the ability to work from anywhere in the world …

There is one more “perk” I have to throw at you.

It’s a perk that very few copywriters know about.

And it comes from a most unlikely source:

Uncle Sam!

Specifically, the Internal Revenue Service.

While mere mention of the IRS can strike fear in the hearts of most U.S. taxpayers — this is one instance where the IRS can actually help you become richer.

Now, I’m not an accountant or a registered financial advisor — let me make that very clear up front.

What I’m telling you here is something I’ve experienced for myself as a freelance copywriter. So, you definitely want to talk to your accountant or financial advisor before you do anything based on what I’m about to share with you.

But here’s the bottom line:

There exists a kind of “retirement loophole” that the government makes available to self-employed people that’s perfect for writers, like us.

I’ll explain why it’s perfect for writers in a minute.

But when you’re a writer who generates income as a freelancer — and you’re required, like all freelancers are, to pay self-employment tax …

You’re allowed to set up and contribute to something called a “SEP” retirement account, which is the acronym for “Simplified Employee Pension Plan.”

And like most retirement savings plans, the money you deposit into your retirement account is tax-deferred …

Which means the amount of money you contribute is deducted from your income before your taxes are calculated. That lets you save money now … by “deferring” the taxes you pay until you spend that money in retirement when, presumably, you’ll have fewer expenses and you’ll require a lower income.

But what’s great about a SEP plan over the kind of IRA you can contribute to as a paid employee is the amount of money you’re allowed to put in every year.

Instead of a $7,000 maximum deduction you have with a typical IRA — freelancers who set up a SEP account can contribute up to 25% of their income … to a maximum of $56,000 for 2019.

Which means, even if you only earn $50,000 as a writer — you can contribute $12,500 of it to a SEP … or $5,500 more than a traditional IRA.

Earn $100,000 and $25,000 can go directly to your SEP.

Earn $200,000 — which is about what the average established, successful copywriter is earning these days — a full $50,000 can go directly into your SEP account.

Why is this so exciting — and so important to your future?

Well, let’s take a look at the numbers, using a $100,000 income as an example.

A $100,000 income puts you in the 24% tax bracket, which means assuming your taxable income is $100,000 — you’d owe the federal government $24,000.

But when you contribute $25,000 to your SEP — your taxable income falls to $75,000, which puts you in the lower 22% bracket. So, not only do you owe taxes on a lower amount, you pay a smaller percentage.

In this example, the federal income tax you’d owe could be just $16,500 — $7,500 less than had you not contributed the maximum $25,000 amount to your SEP.

“The Most Powerful Force in the Universe”

But the immediate tax savings is the least compelling reason to set up and contribute to this secret little IRS-approved retirement “loophole” for copywriters.

Where it really gets exciting is just how big and how fast that money you contribute every year grows!

That’s because any income you earn in a retirement plan grows tax deferred as well — meaning you’re not taxed on the interest you earn like you might when it comes to a “non-retirement” savings or brokerage account.

And through simple compounding interest — a phenomenon Albert Einstein called “the 8th wonder of the world” and “the most powerful force in the universe” — you’ll be amazed at how rich you’ll be simply by contributing each year.

And the sooner you start, the better.

Let me show you.

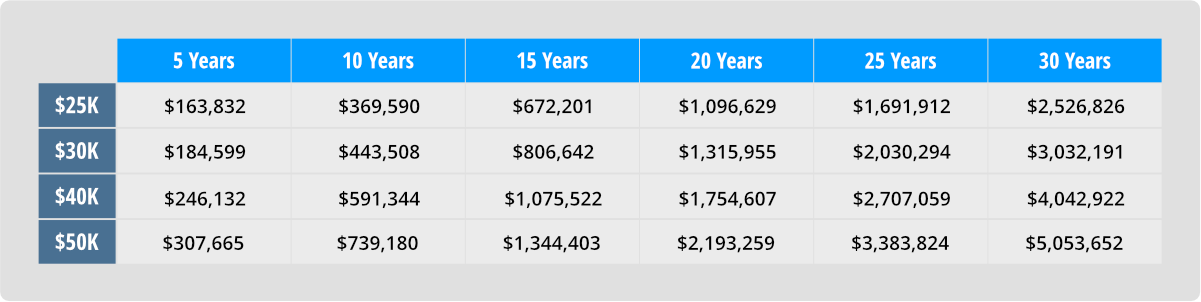

Again, using $100,000 as your income figure, let’s assume you contribute $25,000 per year to your SEP and invest it in a simple low-fee Vanguard® fund that earns an average of 7% a year.

In five years, you’ll have $153,832 … about $28,800 more than you contributed, not counting the roughly $37,000 you were able to defer in taxes.

In 10 years, your balance has grown to $369,590 — which is $119,590 more than the $250,000 you put in — plus your roughly $75,000 in tax deferrals.

In 20 years, your savings account will have eclipsed the $1 million mark — $1,096,629 to be exact.

That’s $596,629 in interest you’ve earned over and above the $150,000 you’ve deferred in taxes.

And it’s all because you quietly tucked away the same amount every year — and enjoyed the yearly tax savings as you went.

If It’s So Good, Why Do So Many Freelancers Not Do It?

Now, I realize it’s hard to get your head around looking 20 years into the future. And that’s why most people will never take advantage of this amazing wealth-generating tool.

And that’s a shame.

Because think about it …

If you’re 50 now — and you keep packing money into your SEP account until you’re 70 — it means you can have a $1 million retirement waiting for you, simply by taking advantage of this little-known freelancer’s retirement tool today!

If you’re younger and you have more years to save — the numbers are astonishing!

Recently I was talking about SEPs with a freelancing colleague who had never heard of them.

She’s 39 years old — which means she has a full 30 years before she’d probably want to start thinking about retiring.

I ran the numbers — and the outcome was incredible:

The money she’d have waiting for her in retirement contributing just $30,000 per year to her SEP would be an astonishing $3,276,545 — that’s $2.35 million more than the $930,000 she would have contributed from her earnings, $30,000 at a time, over 31 years!

And remember …

That’s assuming you only put in $30,000 …

As you earn more money and up your contributions — that’s when the numbers really go crazy.

Have a look at this chart and look at the money you’d have in 10, 20, and 30 years based on varying contributions. (Based on average annual 7% returns.)

Amazing, right!

And if you happen to be in your mid-20s or early 30s and you have 40 years to grow your nest egg — get ready to be blown away …

By contributing just an average of $30,000 each year, you’ll have over $6.4 million waiting for you when you’re ready to retire!

Which brings me to why a SEP retirement account is so ideal for writers.

Because no matter what age we start writing, one of the nice things about being a writer is you never have to retire! (Unless, of course, you really want to.)

In fact, copywriting really is the ultimate “retirement” career.

It’s not physically demanding.

You can do it from anywhere.

And you can write about things that leverage your life and career experiences into a fantastic income.

So, if you enjoy writing — not only can you use a SEP to build up a nice storehouse of wealth so you can live the life you want … travel the world in luxury … and never have to worry about money ever again …

You can keep earning money as a writer well into your retirement years — and simply live off the potential $75,000 to $150,000 income on the money you’ve saved …

Without having to touch the principle!

Pretty sweet, huh?

But here’s the reality.

Very few writers will bother to set up a SEP account.

One reason is, as writers, we’re typically not as interested or “tuned in” to investing and financial return outcomes.

Or we do what I did when I first started making good money as a writer: which is to “ratchet up” our lifestyles by buying new cars and bigger houses, without thinking about investing any of it in something as powerful as a SEP!

I’m not preaching here …

I’m telling you this because the biggest regret I have in my 20-plus years as a copywriter is not jumping all over this “SEP Miracle” earlier. Because, had I contributed the average $43,000 I was entitled to contribute when I started earning serious money as a copywriter …

I would be over $2 million wealthier today!

So please …

Don’t make the mistake I made early on.

It’s not often the U.S. tax code actually helps writers like us (or anyone, for that matter) make more money.

Talk to your accountant or financial advisor about opening a SEP the instant you start earning money as a copywriter — and put in as much as you possibly can, every year.

I promise you — there’s nothing like waking up one morning in the not-so-distant future to discover you’ve got a million dollars (or more) socked away!

Do you have any questions about how to get started as a copywriter? Please share in the comments so we can point you in the right direction.

The AWAI Method™ for Becoming a Skilled, In-Demand Copywriter

The AWAI Method™ combines the most up-to-date strategies, insights, and teaching methods with the tried-and-true copywriting fundamentals so you can take on ANY project — not just sales letters. Learn More »

Key words are tax-deferral - not TAX FREE. I had a 401k through work I saved into. The gov attached a penalty to it. When I lost my medical job because I refused to take a flu shot, I was penalized $8100 above the taxes because I couldn't make it to 59-1/2 & had to use the 401k to live on above my savings. Couldn't find another job in my industry because they're gone now. CPA said no flu shot, no hardship case here. Better to get whole life insurance! Don't trust Uncle Sam!

Cheryl Sharp –

This is terrific for writers from U.S.A. What about writers from other countries? I am from India.

Prashant –